I Tried A Budgeting App To Reach My Financial Goals And Here’s What Happened

Money, money, money

By Dinushka Gunasekara | 17th January 2024I would describe my relationship with money as love/hate – I love it when I have it, I hate it when I don’t.

Navigating my finances has always been a stab in the dark, full of postponing catch ups when a bill notification hits my inbox, checking out on Afterpay to make that impulsive purchase a later problem, and tapping my card with fingers crossed. Money makes the world go round, and mine is running circles around me.

But hey – new year, new me, right? Move over La Niña because it’s my time to make it rain, and that means getting on top of my moolah. Enter mymo by BCU.

Basically a financial assistant in your pocket, the (free!) mymo app guides you through the depths of your financial journey, ensuring there are no unexpected hurdles along the way. With handy features designed to make your money work for you, it houses all your accounts from any Australian financial institution in one read-only space, giving you the ease to see exactly where your money is coming and going, while changing its path towards a brighter financial future.

To set my app up, I became a BCU Bank member by opening a BCU transaction account, and used my new membership details to log into mymo. From there, I loaded in all my existing bank accounts (made easy with Open Banking, which also allowed me to dictate how long BCU could access my data), and then let mymo do its thing.

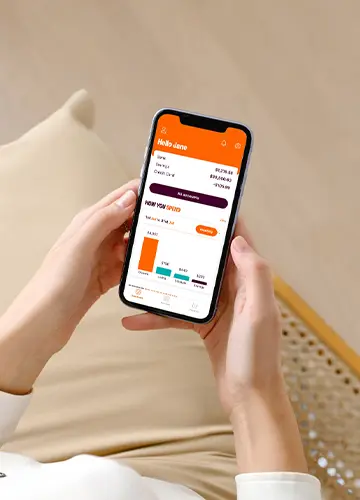

In all honesty, it didn’t take me long to go back to my old ways – out of sight, out of mind – and I initially forgot I had the app. But turns out, even while I wasn’t looking at it, mymo was working hard to get my money in order. Transforming my transactional data into valuable financial insights, mymo kept an eye on my spending and automatically allocated my habits into digestible buckets – income, living, lifestyle, and savings. When I finally jumped back into the app, it took seconds to sort out any uncategorised transactions into its correct bucket (aka that random $20 I transferred to a mate thanks to a bet I lost), and I immediately had a better understanding of how I use my money than ever before.

The simple dashboard showed me in a neat table my spending habits at a glance. The summary? Your gal could be writing the sequel to Confessions Of A Shopaholic. Offering a monthly insight into my spending as well as a three-month average so I could see exactly how exorbitant my UberEats ordering has become, mymo gave me a much-needed wakeup call made cute in bright orange and soothing teal.

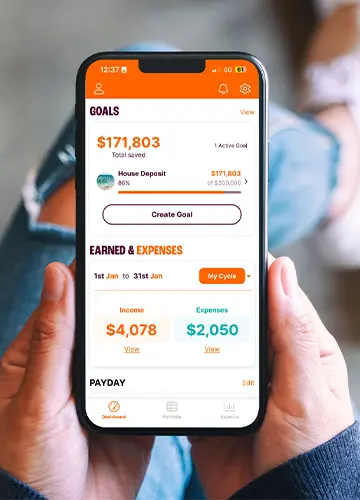

Where before I would’ve opted for retail therapy to make me feel better, the mymo app empowered me to pull my nonsense together. I tracked my bills so I could see when they’re coming before the next-day text message. I let mymo know my pay cycle and the app – like me – excitedly counted down to payday with an enthusiastic ‘woohoo’. I set up budgets based around my income to realistically enjoy all the good stuff money can buy without going overboard. And having seized control of the now, it was time to look to the future – goals, baby!

In true manifestation style, mymo lets you create a savings goal complete with a picture, target, and end date. From there, it tracks by percentage how close you are to hitting the mark. My goal is to get a dog, but not just any old furry friend – I want to adopt a shelter dog and turn it into an absolute princess. RM Williams collar. Frank Green water bowl. Orthopaedic bed. No expense will be spared for my four-legged baby, which means I need to save the money to make it happen. And guess what? Since setting my goal on mymo, I’m already 20% there!

While I’m nowhere near being the next Barefoot Investor, I genuinely feel I have better control of my finances in a way that works for me. I’m still indulging in my iced vanilla almond lattes, but I’m also actively moving towards my financial goals; all it takes is a quick glance at the app to ensure I’m on track. Now that’s easy money!

Ready to make your money work for you? Find out more about mymo by BCU here.